with High-Yield Bonds

Earn up-to 17% returns and diversify your portfolio and potentially earn attractive returns by

investing in bonds via Tap Invest

Unlock the value of fixed-income bonds with Tap Invest

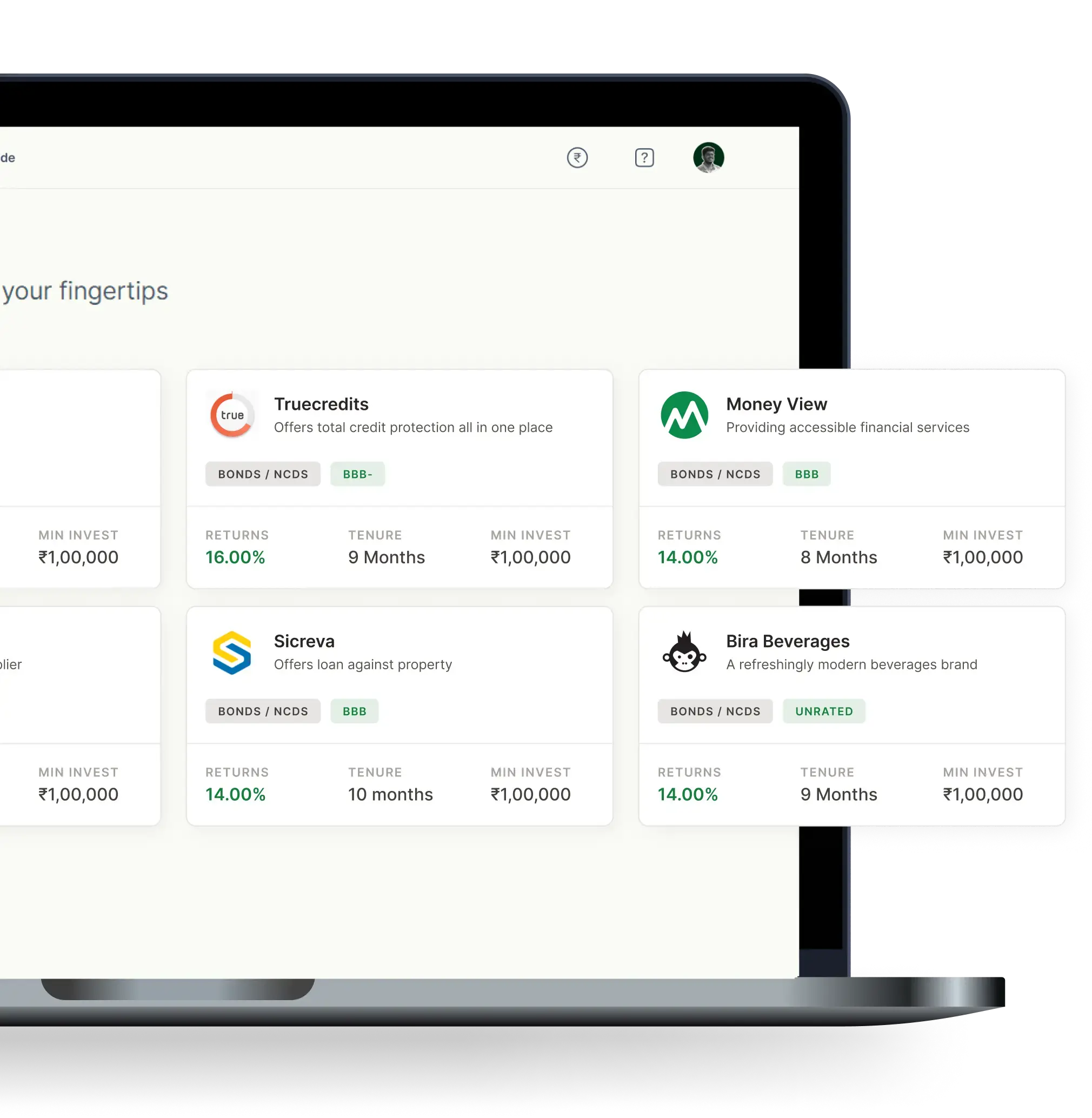

Flexible Investment Options

At Tap, we understand that every investor has unique needs and goals. That's why we offer a wide range of investment options tailored to fit your specific requirements.

Reduced Risk

With Tap, you can invest confidently, knowing your hard-earned money is safe. We facilitate all our transactions via the depositories so that you get them directly in your demat.

Predictable Income

Our fixed-income investments are designed to provide consistent returns, allowing you to confidently plan your finances. Choose between monthly, quarterly and yearly payout structures with fixed returns known while investing.

Offering you

Digitised Journey to Invest in Corporate Bonds

Super seamless, transparent and secure

At Tap, we pride ourselves on providing a super seamless user experience that is both transparent and secure. With robust security measures in place, your personal information and investments are protected at all times, giving you peace of mind and confidence in your financial decisions.

Investments go straight to your demat account

When you invest with Tap, your investments are directly credited to your demat account, ensuring a smooth and efficient transaction process. This direct approach eliminates any delays or intermediaries, allowing you to have immediate and full control over your assets.

In-house bonds expert to assist you

Our team includes in-house bond experts who are always ready to assist you. Whether you need guidance on choosing the right bonds, understanding market trends, or managing your portfolio, our experts are here to provide personalized, one-on-one support tailored to your specific needs.

Calculate potential returns on your investments

- Start with a minimum amount of ₹10,000

- Returns up to 17% across diversified investments

- Grab stable money returns!

Your returns after 5 years:

₹18,42,435.18Type of Investment

Frequently asked questions

Everything you need to know about Tap Invest.

What are Bonds ?

Bonds are a type of loan instrument, these are debt securities issued by the Government, private, and public corporations. Companies issue corporate bonds to raise money for a variety of purposes, such as building a new plant, purchasing equipment, or growing the business.

What are Unlisted bonds?

Unlisted bonds, also known as private bonds or non-public bonds, are debt securities issued by companies, governments, or other entities that are not traded on public exchanges like the stock market.

What do you mean by Coupon rate?

The coupon rate of a bond is the fixed annual interest rate that the issuer pays to the bondholders. It's typically expressed as a percentage of the bond's face value. ex- If a bond has a face value of 1,000 and a coupon rate of 5%, the issuer will pay 50 in interest annually (1000*5%)

What do you mean by Yield or YTM (Yield to maturity)?

The yield to maturity is the total expected return on a bond if it is held until the end of its maturity date. It takes into account the bond's current market price, coupon payments, and the time remaining until maturity. Ex- Suppose a bond has a face value of 1,000, a current market price of 950, and pays annual coupons of 50. The YTM is the rate that, when applied to the bond's future cash flows, gives a present value of 950. The bond can be purchased at a discounted rate, which will increase your yield above the coupon rate Or it can be purchased at a premium.

What are senior secured bonds?

Senior secured bonds are a type of bond that takes precedence over other unsecured bonds or debts in the event of bankruptcy or liquidation. This means that if the issuer defaults, holders of senior secured bonds are among the first to receive repayment from the sale of assets or collateral securing the bonds.

What do you mean by face value of a bond?

The face value is the amount of money that the issuer of the NCD agrees to repay the investor when the NCD matures.