Diversify your portfolio with

Invoice Discounting

Earn up-to 14% returns and diversify your portfolio and potentially earn attractive returns by

investing in bonds via Tap Invest.

Why invest in Invoice Discounting?

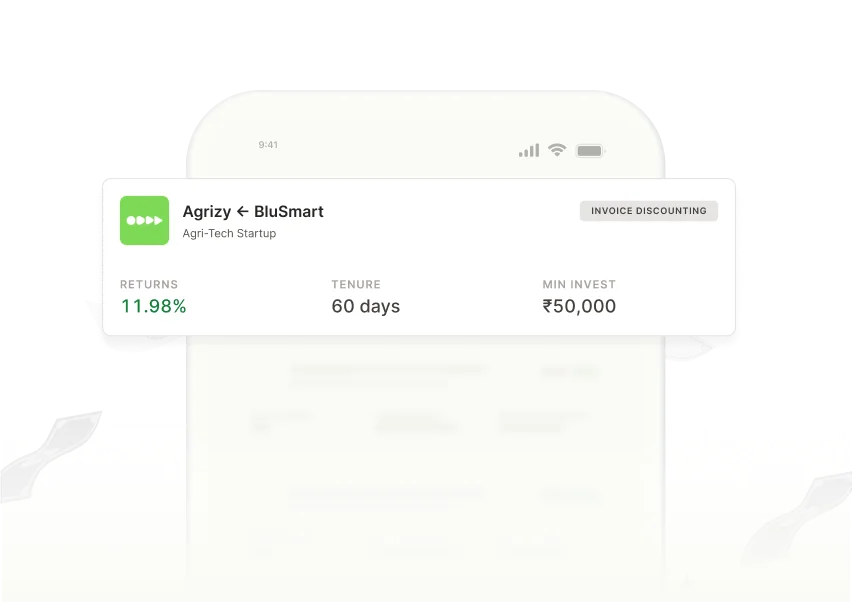

Short tenures with high yields

Earn returns up to 14% on short-term deals across various industries with tenures up to 32 days.

Low Minimum Investment and No TDS deducted

Begin your investment journey with a minimum of just ₹10,000, making it accessible and straightforward to start growing your wealth. Plus, enjoy the benefit of no TDS deduction on your earnings.

Diversification of your portfolio across various industries

Invoice discounting allows you to diversify your portfolio by investing in invoices from various industries. Enjoy stability and growth with a balanced investment approach.

The story behind Invoice Discounting

Customised to make investing simpler and secure

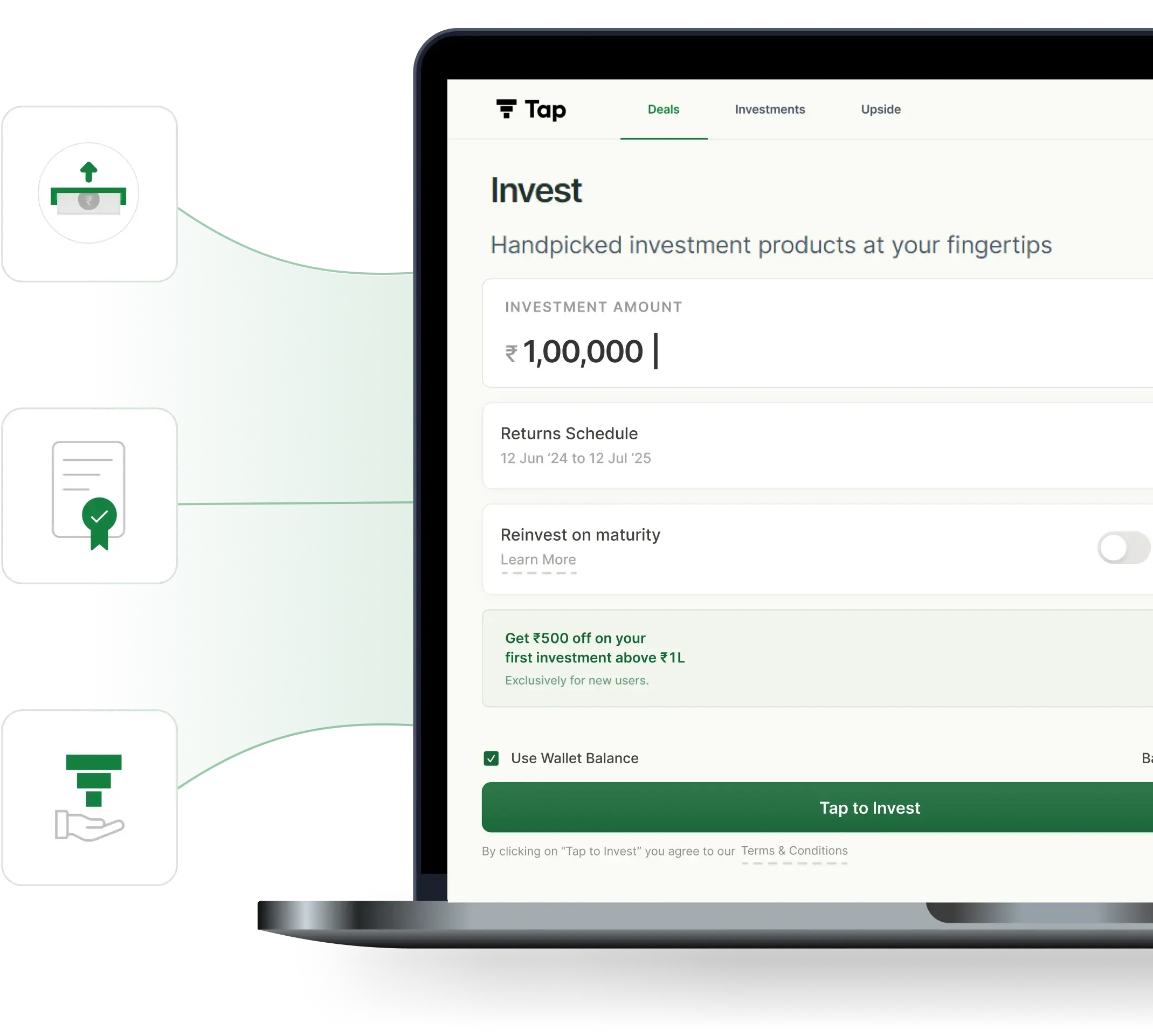

Hassle-Free Reinvestment:

Automatically reinvest your maturing investments into similar deals, ensuring your money keeps working for you.

Diversification of your portfolio across various industries

Invest in invoices of brands from various industries and diversify your portfolio, taking advantage of accelerated growth across various industries.

User-Friendly Platform

Benefit from an intuitive, easy-to-use platform designed to simplify your investment experience.

Calculate your returns, and see for yourself

- Start with as low as ₹10,000

- Earn upto 17% returns in various categories

- Get stable monthly returns!

Your returns after 5 years:

₹18,42,435.18Type of Investment

Frequently asked questions

Everything you need to know about Tap Invest.

What is Invoice Discounting?

Invoice discounting, also referred to as invoice financing, is a process by which businesses borrow money for their short term needs against the money which they will receive from their customers in the future.

How does invoice discounting work on Tap Invest?

Invoice Discounting on Tap Invest is a very seamless and intuitive process. Once you, Tap Investor's customer, sign up on the platform, you will see opportunities to invest in, located in the section on the website showing our live transactions.

What is the structure or instrument of Invoice Discounting?

The Investor buys the right against the receivables, through a “Sale of Receivables Agreement” executed between the Seller (Company), PPIPL, and the Purchaser (the Investor). Once the tenure ends the amount will be transferred to the Investor.

Can I exit the investment in Invoice Discounting before the tenure ends?

These investment transactions have shorter tenures. That being said, there are no provisions to provide early exits to investors.